37+ mortgage insurance premium deduction

Web Access the prior year return not available for 2022 Select Federal from the navigation bar on the left. However if you prepay the premiums for more than one year in advance for.

Is Mortgage Insurance Tax Deductible

Web Yes unfortunately you will miss out on deducting the rest of the Mortgage Insurance Premiums if you refinanced before the 84th month.

. Once your income rises to this level the. Web However in some limited circumstances you may be able to claim a tax deduction when you purchase your insurance plan. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically.

Web Standard Deduction For tax year 2020 the standard deduction is. Choose to select your. For example you can deduct the.

Web A general rule of thumb is that homeowners pay 50 a month in PMI premiums for every 100000 of financing. Keep in mind though that the amount of the. If you have an FHA loan you may be able to deduct.

My post below has more. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. We dont make judgments or prescribe specific policies.

2110 for each spouse Filing Status 2 5 or 6. Be aware of the phaseout limits however. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Also your adjusted gross income cannot go over 109000. See what makes us different. Web Answer In general you can deduct mortgage insurance premiums in the year paid.

The limit is 109000 54500 if. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. 2110 Filing Status 3 or 4.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web If you itemize you can deduct interest on up to 750000 of mortgage debt if you bought your home after December 15 2017 interest is deductible up to 1 million. Select Deductions from the same navigation bar.

Web The reason the Qualified Mortgage Insurance Premium isnt being allowed is because of the limit on the amount you can deduct. Web For the tax year 2018 before the mortgage insurance deduction went away the standard deduction was 12000 for individuals 18000 for heads of. The itemized deduction for mortgage.

SOLVED by TurboTax 5841 Updated January 13 2023. Web Mortgage insurance is required if you have a conventional loan and make a down payment of less than 20. You can use this method to figure the.

After this the deduction will not be. Web According to the IRS mortgage insurance premiums are tax deductible for amounts that were paid or accrued in 2021. Web Can I deduct private mortgage insurance PMI or MIP.

What Is Private Mortgage Insurance Pmi And How To Remove It

5 Types Of Private Mortgage Insurance Pmi

Section 194da Tds On Payment In Respect Of Life Insurance Policy

What Expenses Can Be Deducted From Capital Gains Tax

Agenda

Is Pmi Tax Deductible Credit Karma

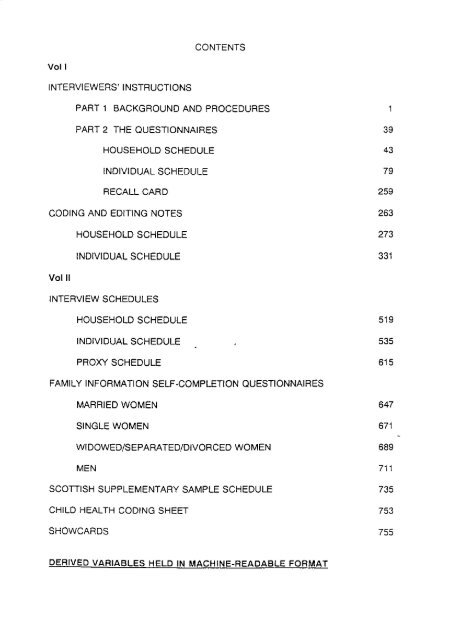

Contents Vol I Interviewers Instructions Part 1 Esds

Free 10 Loan Repayment Agreement Samples In Ms Word Google Docs Apple Pages Pdf

Do You Remember The Last Time You Were Completely Debt Free

Personal Finance Apex Cpe

Calameo 2022 09 Ca

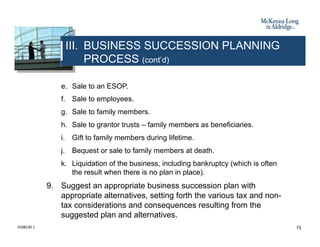

Business Succession Planning And Exit Strategies For The Closely Held

37 Sample Earnings Statement Templates In Pdf Ms Word

Deducting Mortgage Insurance Premiums As Mortgage Interest Deduction

Taxes Explained The Mortgage Insurance Premium Deduction Youtube

Free 37 Sample Receipt Forms In Pdf Ms Word Excel

Taxes Explained The Mortgage Insurance Premium Deduction Youtube